$1 billion loans disbursed and 5 million lives impacted

We Are

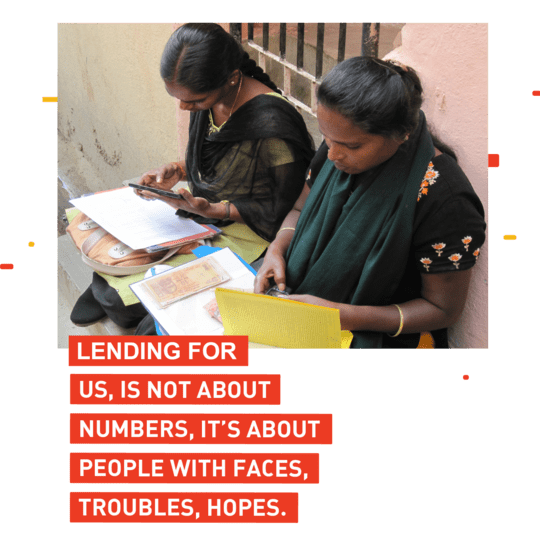

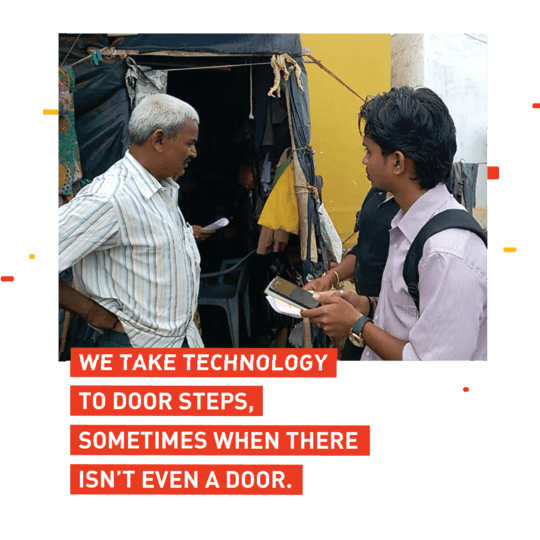

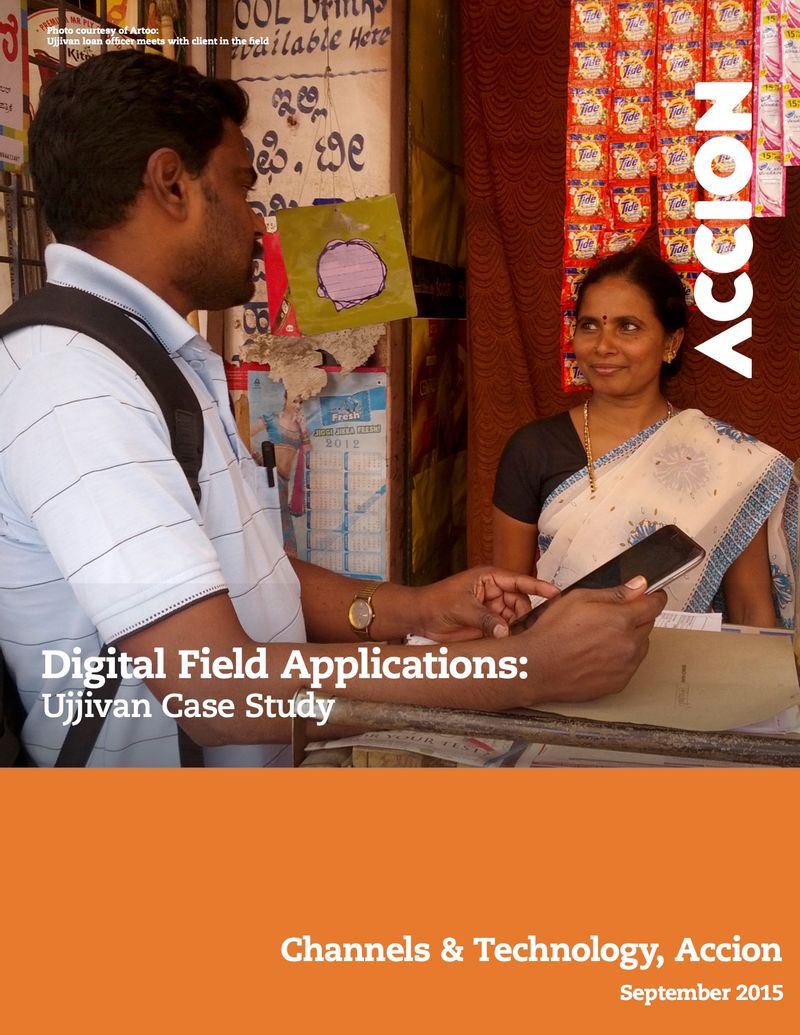

Artoo is an Enterprise Software as a Service (SaaS) company that specialises in MSME lending.

Our software platform enables lenders to effectively serve a borrower base with limited digital footprints, by equipping the field agent with cutting-edge technology at the borrower’s doorstep.

We Believe

We are a new generation of engineers who aspire to doing truly original and innovative work.

We believe Indian engineers must innovate, in India, for India and the developing world, because only we can solve the most pressing problems faced by our parts of the world.

Clients at the Center Prize (2016)

First Runner Up

We Value

Creativity flourishes in an atmosphere of freedom and openness that keeps curiosity alive and is unafraid of irreverance for the sake of the imagination.

Compassion celebrates diversity, prides itself in inclusiveness, and holds in its heart a deep sense of empathy for all those who are excluded

Authenticity comes from unflinching honesty, a commitment to integrity, in the interest of workability, giving rise to an abiding unpretentiousness.

Effectiveness is inevitable given our customer intimacy, the fact that we take responsibility for their outcomes, focusing on areas that have the maximum potential, simply not resting until it just works (for anyone, in any context)!

We Strive

To arrive at our core purpose, we sat down toghether one weekend and asked ourselves the question “Why?” several times. Why do we do what we do?

We do cutting edge technology that includes the financially excluded.

Why is that important? To enable and economically empower them in order to improve their lot.

Why is that important? Because it’s unfair that a few have such huge advantages and the rest are so handicapped.

Therefore, to help provide equality of opportunity i.e

To level the playing field for all.

Goodbye, Artoo, with love and gratitude...

When we got started in 2010, we were pioneers of doorstep digitalization for financial inclusion. We built technology for microfinance and small business lending when none existed. We empowered field agents to better serve borrowers. High tech and high touch—this is the way forward.

In 2020, the microfinance and small business lending sector has evolved to the point where it has merged with mainstream banking as the top MFIs are becoming Small Finance Banks. While there is lots more work to do, we believe we have helped the industry move forward as best we could.

It’s been a wonderful decade and so the ending is bittersweet. A BIG thank you to our clients, investors, partners, vendors, advisors, teammates, families, and supporters. Without their encouragement, love and sacrifice none of this would have been possible. Thank you, thank you!

For more, please reach out to Sameer Segal or follow the ongoing adventures of our Trillers.